At our Mastt launch party on 14 November 2019, I presented to our audience the journey of Mastt in a transformational context of what we’re doing Now, Soon and in the Future.

For this post, I won’t get into Automation or our role in the construction Ecosystem of the future. We will save that for a series of blogs. Today, the now for Mastt is very much a around ‘Data’ as we start to unlock the value of data that has previously been left dormant in excel spreadsheets and documents.

Read our first article “Spreadsheets are putting your Project and Portfolio Management at Risk”

Unlocking this data provides new, never before possible levels of project information which is enabling the transformation of capital projects in many ways. The ability to analyze structured and unstructured data within and across projects to discover trends, predict outcomes, and improve decision-making in a portfolio is driving the complete re-framing of capital project and portfolio business models which we will explore in this article.

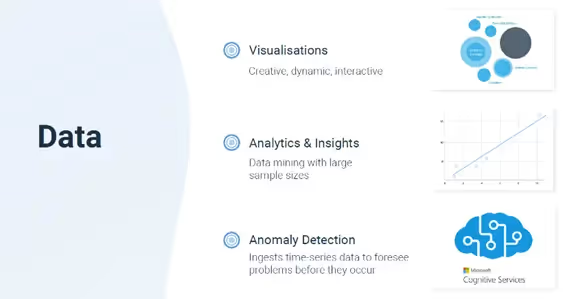

Until now, this data has been inaccessible and impossible to make sense of. Working in a system environment and out of documents and spreadsheets offers organizations the benefits of being able to use that data to drive in real-time:

- Visualizations — creative, dynamic and interactive information

- Analytics — making sense of project outcomes with answers that are data-driven

- Anomaly Detection — with enough time-series data, foresee problems before they occur using applications of Machine Learning

However, behind all of these buzz words, the key enabler in all of this is being able to use vast amounts of available data and actually extract useful information, making it possible to reduce costs, increase efficiency and spot risks and issues before they occur.

Mindset - Treat Project Data as an Asset

Maintaining data as an asset requires organizations to not only get off hard copies, documents and spreadsheets ASAP and move into a digital project and portfolio controls system, but also to consider first and foremost a data collection system.

Considering our key enabler above, short sighted organizations will consider implementing a SharePoint or old software system for their portfolio management, however it is important to recognize where these options fall short and don’t possess the necessary data collection capabilities. There is simply no easy way to stay on top of these data-sets without a new project controls technology and advanced data collection system. No matter how experienced your in-house team is, they won’t be able to store, analyze and interpret thousands of statistics a second.

A powerful Machine Learning 🤖solution can (which we’ll explore later) so its important to select a system that can centralize project information across the organization in one accessible place (I don’t mean your local drive or O365 account 😳).

Make Sense of Data with Dynamic, Interactive Data Visualizations

With your data collection system set-up through a project controls technology like Mastt built on the latest in Microsoft Azure products and services, managers have the infrastructure to rapidly sort through millions of data points to find answers. Whilst Power BI and other charting systems are great, the latest in data visualization using d3 charts provides organizations with an incredibly enriched view of their information, giving them significantly more opportunity to act on their data — an opportunity that they never had previously.

With this new, enriched capability, companies can compare the impact of hundreds of performance drivers on project or business outcomes. They can also identify the obstacles that raise costs and extend timelines. In some areas, advanced analytics may produce savings of up to 25 percent. The capital-projects unit of a large government department in Australia used advanced analytics to identify drivers of capital efficiency, interrogate the data, and assess other areas of opportunity to return millions of dollars to the government for reinvestment into new scope.

Beyond Visualization and Into Intelligence with Machines

Given the quantity of data that capital works portfolios are managing, a new method of predicting, rather than reacting, to changes in data is required. To attempt this through manual analysis alone would lead to sluggish decisions based on immediately outdated information, and while visualizing data is cool, it still requires structured data and organizations knowing what to look for.

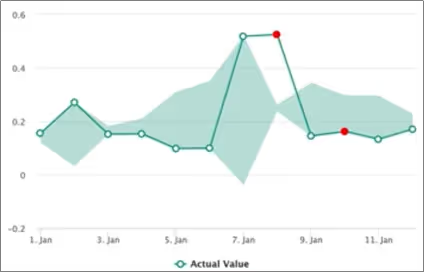

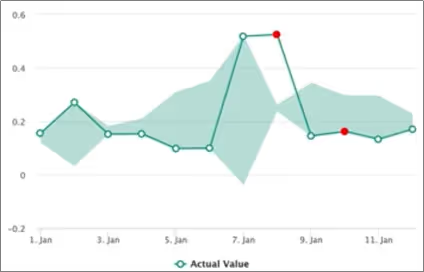

To get past that, Mastt has developed a global first project Anomaly Detector that allows organizations to automate identification of risks and issues and foresee problems before they occur. Yes, you heard correctly, before they occur. This is an AI service that ingests time-series data of all your organizations projects and using Machine Learning, selects the best-fitting detection model for your data to ensure the absolute highest accuracy.

Put simply, the Machine Learning engine receives project and user data points in the millions and identifies patterns and benchmarks for what the engine has determined to be a successful project.

How strict or relaxed we set the Machine Learning engine to be is up to the organization, however we’ll call the patterns generically ‘best practice’.

“This is an AI service that ingests time-series data of all your organizations projects”.

With your data being put to work in a data collection system, in real time we can track and compare a live project against the best practice pattern. If the trend of the live project steps outside of the boundaries, we have identified a leading indicator of a problem on the project or by a user. Typically, anomalous data can be connected to some kind of event that we can then bring to the attention of the project or user as a leading indicator of issues or risks. With Anomaly Detection, the moment a trend or new pattern on your project isn’t recognized by the system you’ll know about it.

There are endless patterns of data that can be identified in a project, however as an example using some mock-demo data watch a video of our Mastt Anomaly Detector in action here.

Rapidly Maturing Technology

Anomaly Detection is a powerful AI service hat will help capital works portfolios quickly analyze their entire volume of organizational information in real-time. At this stage however, there is still a long way to go for Anomaly Detection and application of Mastt in this space. However, Machine Learning platforms haven’t reached their limit and alongside Mastt both are rapidly maturing technologies. The long-term learning potential of these systems puts them in a constant state of evolution and the more experience we develop in this space, the more potent they will become.

What’s more, these types of AI driven systems coming in other industries like banking, are beginning to provide simpler interfaces that allow people other than data scientists to work with anomalies, fine tune to minimize false positives and false negatives, and otherwise manage their businesses with improved accuracy. We’ll look at what capital works portfolios can learn from other industries in a future article. However for now, its safe to say that in the future, no portfolio will operate without Anomaly Detection. Whether its Mastt or others, its inevitable.

Why Does our Industry Need This?

The rising popularity of data and AI platforms all comes down to efficiency. It is impossible to manage data that you can’t interpret or understand information on-demand using standard data visualization techniques.

Capital works portfolios in particular need to be able to respond to fast-moving changes to data at the drop of a hat to stop cost blowouts or time delays as as soon as possible. Immediate responses are particularly crucial for time-poor portfolio managers who are responsible for complex portfolios of work and receive their project status updates 30–60 days after an event has occurred.

Anomaly detection platforms can delve down into the minutiae of data to pinpoint smaller anomalies that wouldn’t be noticed by a human user monitoring dataset on a dashboard. As a result, the only way to get real-time responsiveness and be a real data-driven capital works portfolio is to use a Machine Learning platform.

If you’re interested in speaking more with us on this topic or looking to set up a data-collection system for your organization, please contact me on doug@mastt.com.au

.avif)