An application and certificate for payment is the formal process contractors use to request payment for work completed on a construction project. An accurate payment application keeps cash flowing, avoids disputes, and builds trust across the project team.

In this guide, we’ll walk through how an application and certificate for payment work, who’s involved, and the steps to complete and review one correctly.

What is an Application and Certificate for Payment?

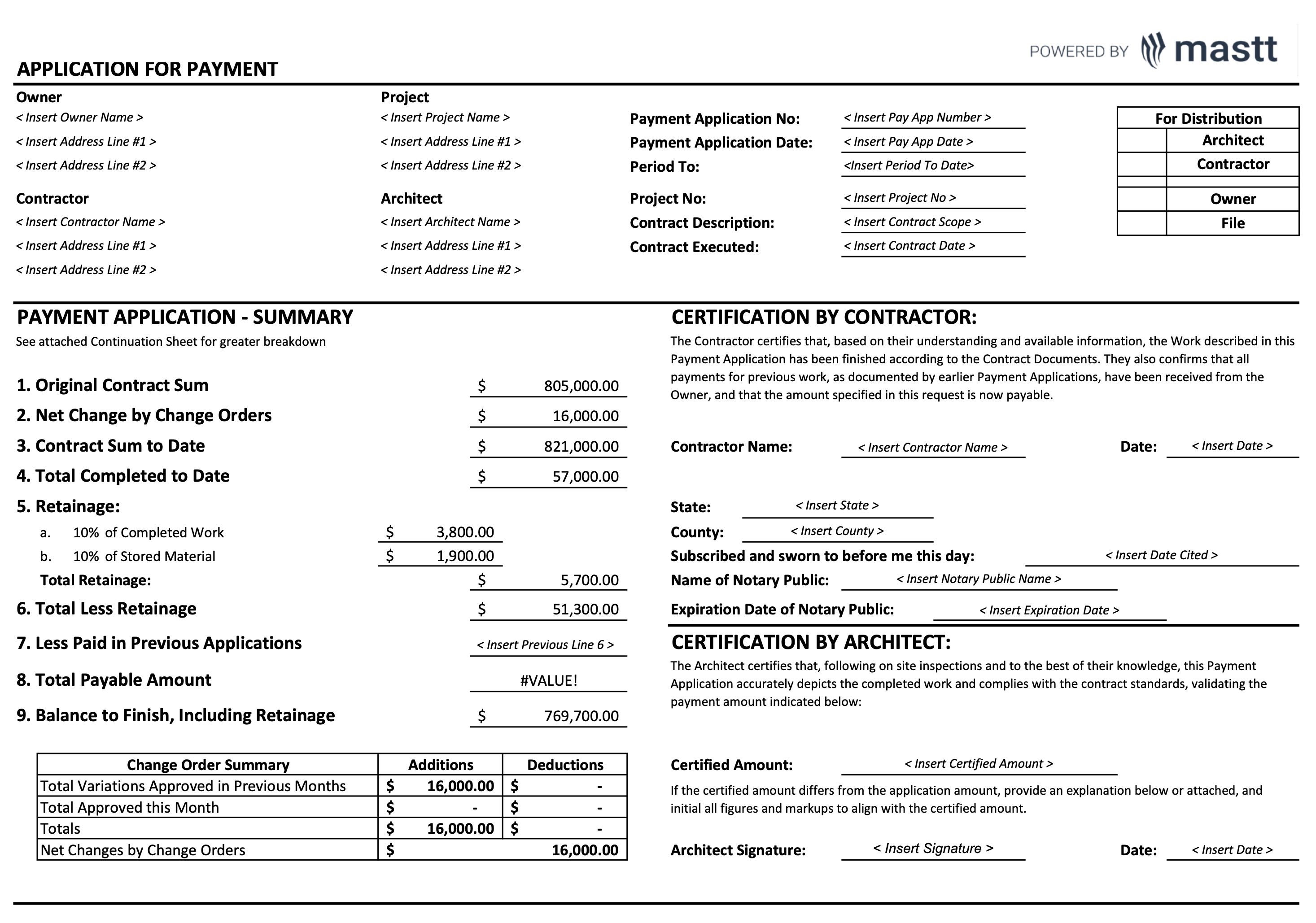

An application and certificate for payment is a formal written document that a contractor submits to request payment for work completed and materials stored during a specific billing period. It’s reviewed and certified by the project manager, architect, or owner to confirm that the completed work meets contract requirements and is approved for payment.

The application and certificate for payment includes key details such as total work completed, approved change orders, retainage held, and current payment due. In many projects, it serves as the official step between progress in the field and money leaving the owner’s account.

Why the Application and Certificate for Payment Process is Important

The application and certificate for payment process keeps project finances accurate and transparent. It ensures contractors are paid for verified work while giving owners a clear view of project progress and costs.

Here’s why it matters on every project:

- Prevents payment disputes: Each payment is backed by verified progress and documentation.

- Improves cash flow control: Contractors get paid on time, and owners can plan disbursements based on real progress.

- Tracks project performance: Payment data reflects how much of the project is complete versus the total contract sum.

- Ensures accountability: Certification confirms that work meets contract standards before payment is approved.

- Supports financial reporting: The process provides an audit trail for lenders, consultants, and accountants.

💡Pro Tip: Treat every payment application as a financial checkpoint. Reviewing progress, costs, and supporting documents at this stage helps catch scope creep, unapproved work, or missing documentation before they become bigger problems later.

Who Prepares and Reviews the Application and Certificate for Payment

The contractor prepares the application and certificate for payment, which are then reviewed and certified by the project manager, architect, or owner before payment is released. Each role in the process carries specific responsibilities that ensure accuracy and accountability.

- Contractor or Subcontractor: Prepares and submits the payment application with supporting documents such as invoices, continuation sheets, and change orders.

- Project Manager or Architect: Reviews the application for accuracy, confirms progress on-site, and certifies that the completed work meets contract terms.

- Project Owner or Developer: Approves and releases payment based on the certified amount and contract schedule.

Subcontractors often provide their own payment applications to the general contractor, who consolidates them into one project-wide submission. The review process confirms that work billed aligns with actual progress, protecting both the paying party and those performing the work.

Key Components of an Application and Certificate for Payment

An application and certificate for payment include essential financial details that verify project progress and determine how much is owed for a billing period. Each section works together to give a full picture of contract value, completed work, and outstanding balance.

- Project Information: Lists the project name, number, address, and billing period for reference.

- Original Contract Amount: States the total value of the construction contract before any changes.

- Change Orders to Date: Shows all approved additions or deductions to the contract amount.

- Total Completed and Stored to Date: Reflects the cumulative value of work performed and materials stored on-site or off-site.

- Retainage: Identifies the percentage withheld from payment until project completion or milestone approval.

- Current Payment Due: Indicates the amount requested for the current billing cycle.

- Previous Payments Received: Records payments already made to date.

- Balance to Finish, Including Retainage: Shows how much remains unpaid under the contract, helping track financial progress.

💡Pro Tip: Use consistent line items and numbering between your payment applications and schedule of values. When every section aligns, it simplifies reviews, reduces confusion, and speeds up approvals.

Supporting Documents That Strengthen an Application for Payment

Supporting documents give proof that the billed work is complete and eligible for payment. These attachments make the payment request transparent and verifiable, helping reviewers confirm accuracy without extra back-and-forth.

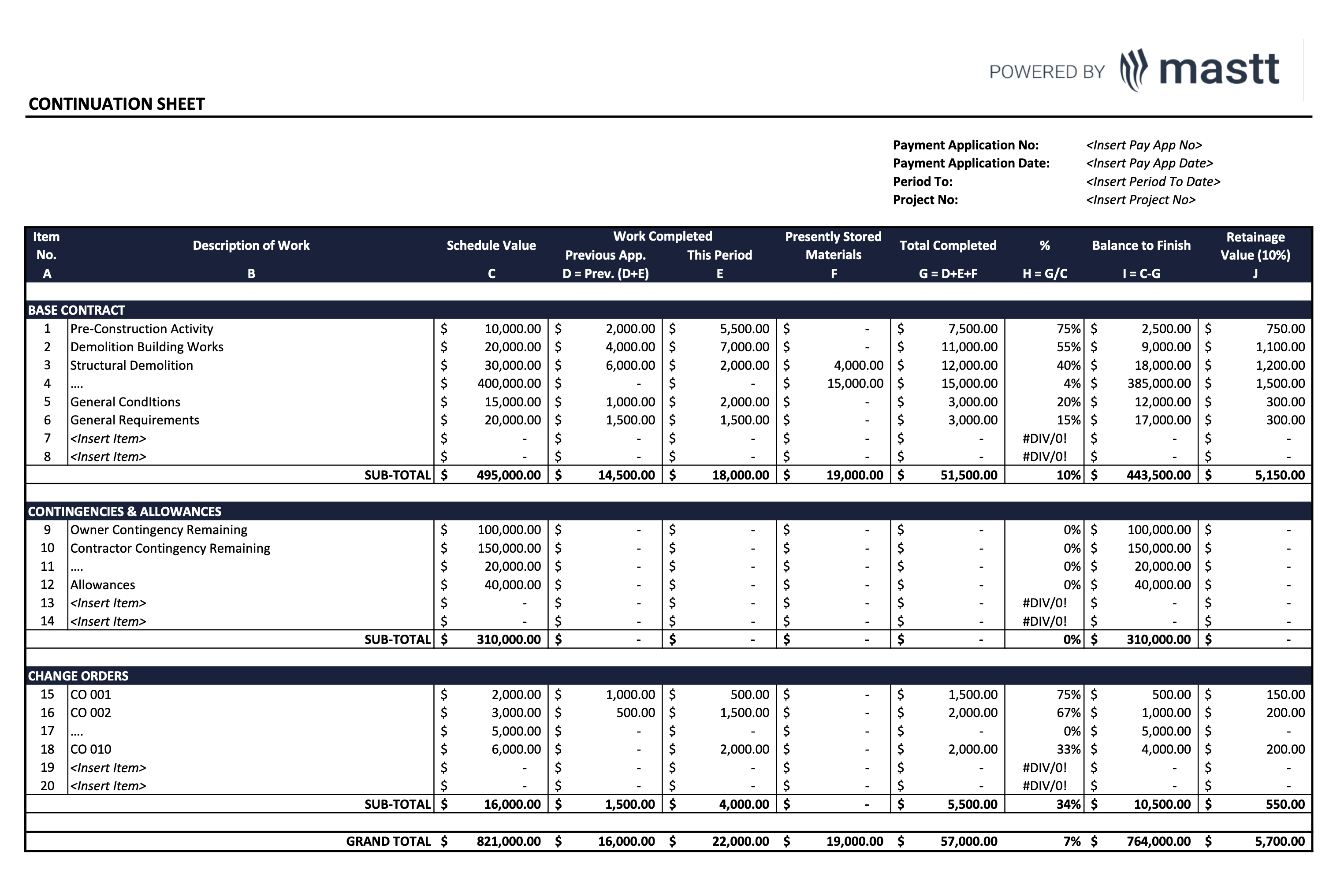

- Schedule of Values (SOV): Breaks down the contract sum into detailed line items that track cost and progress.

- Continuation Sheet: Lists progress and dollar value for each work item, showing total completed to date and balance remaining.

- Change Order Log: Summarizes all approved and pending contract changes that affect payment.

- Progress Photos or Reports: Provide visual or written evidence of completed work, useful for remote reviews.

- Subcontractor Payment Applications: Support the main contractor’s payment request by demonstrating progress at lower tiers.

- Lien Waivers: Confirm that subcontractors and suppliers have been or will be paid, protecting the owner from future payment requests.

💡Pro Tip: Always cross-check every supporting document against the current billing period. Reviewers often reject payment applications when attachments show mismatched dates, quantities, or change order numbers, even if the work itself is accurate.

How to Complete an Application for Payment for Contractors

To complete an application and certificate for payment, gather accurate project data, confirm work progress, and document it clearly. The form should reflect real progress, match supporting records, and be organized for quick review and certification.

1. Verify Project Details

Start by confirming the basics: project name, contract number, billing period, and application number. Mismatched dates or codes can cause accounting issues or delay approval. Always use the same naming and numbering format used in previous submissions.

2. Update the Schedule of Values

Adjust each line item to show updated completion percentages, stored materials, and approved change orders. Make sure the totals reconcile with site reports and subcontractor requests. This keeps your billing consistent with real progress in the field.

3. Calculate Completed Work and Retainage

Apply the correct retainage rate as stated in the contract. Verify cumulative totals so that no line item is overbilled or duplicated from prior applications. Small math errors can hold up large payments.

4. Attach Supporting Documentation

Include continuation sheets, change order logs, lien waivers, and any other required proof. Reviewers depend on these to validate your claimed progress without making extra site visits.

5. Check Math and Totals Carefully

Recalculate all columns before submission. Confirm that the current payment due equals the total value of completed work minus retainage and previous payments. Precision here protects your credibility and keeps approvals moving.

6. Submit for Review and Certification

Send the completed application to the project manager, architect, or owner, as specified in the contract’s payment schedule. Late submissions can throw off the entire payment cycle or delay downstream payments to subcontractors.

7. Track Payment Status

Document submission, certification, and payment dates. Follow up if timelines slip. A well-maintained payment log helps forecast cash flow and flag bottlenecks early.

Once submitted, the application goes through several checks before payment is approved. The certification process verifies that the contractor’s payment request is accurate, contract-compliant, and supported by real progress.

How to Review the Application for Payment as a PM

To certify a payment application, the certifier must verify that the billed work is accurate, compliant, and ready for payment approval. The process focuses on validating progress, confirming documentation, and ensuring payments match the real value earned.

1. Review the Application Thoroughly

Start by reviewing the submitted payment application and attachments. Check quantities, values, and progress against the schedule of values, drawings, and specifications. Look for errors, inconsistencies, or missing data before moving forward.

2. Verify Work Against Contract Terms

Confirm that all completed work matches the contract scope and any approved change orders. If something appears overstated or outside scope, request clarification from the contractor before certifying payment.

3. Validate Progress On-Site

Conduct a field walkthrough or review progress reports to ensure the claimed percentages reflect actual work completed. This step confirms that payment is tied to measurable progress, not estimates.

4. Confirm Retainage and Prior Payments

Check that retainage is correctly applied and previous payment totals align with cumulative values. This helps prevent overpayment or gaps between billing periods.

5. Certify and Approve for Payment

Once all values and progress are verified, sign and certify the application for payment. This certification authorizes the owner’s finance or accounting team to process payment according to the contract schedule.

💡 Pro Tip: Keep a running certification log. Tracking each approval with notes on verified progress and adjustments creates a clear audit trail and protects both the owner and certifier if payment disputes arise later.

Common Mistakes in the Application and Certificate for Payment and How to Avoid Them

The most common mistakes in payment applications are missing change orders, math errors, and using outdated forms. Each mistake creates extra review time and slows down cash flow.

Here’s how to spot and prevent them early:

💡Pro Tip: Before every submission, review your payment application with a team member who wasn’t directly involved in preparing it. A second set of eyes often catches inconsistencies or missing items that the preparer might overlook.

Best Practices for Reviewing Payment Applications for PMs and Architects

The best way to review payment applications is to build a consistent, transparent process that balances accuracy and speed. A strong review system helps avoid payment disputes, keeps records clean, and ensures fair progress evaluations.

✔️ Review on schedule: Stick to a regular review timeline so contractors can plan cash flow and avoid late payments.

✔️ Keep communication open: Discuss unclear items directly with contractors before marking them for revision. Quick calls save days of back-and-forth emails.

✔️ Document every change: Note all adjustments or clarifications made during review. This record helps justify approvals and protects against future payment requests.

✔️ Separate field validation from financial checks: Conduct site verification first, then review numbers. Mixing both can lead to missed details.

✔️ Use the same reviewer when possible: Consistency in reviewers ensures better accuracy and a deeper understanding of project progress over time.

✔️ Flag trends early: Repeated overbilling or incomplete documentation may point to deeper issues with project tracking or reporting.

✔️ Use a standardized checklist: Apply the same review checklist for every project to keep the process objective and efficient.

✔️ Use a standardized template: Always review payment applications using a consistent format or digital template. Mastt provides a ready-to-use pay application template that makes reviews faster, easier, and audit-ready.

✔️ Adopt digital review tools: Use construction management software to review, track revisions, and store payment records in one place.

💡Pro Tip: Always flag minor discrepancies early and communicate them directly with the contractor before certification. Quick clarification on minor issues prevents payment delays and keeps trust strong across the team.

Final Thoughts: Building Trust Through Clear Payments

Application and certificate for payments are records of progress, accountability, and trust in a project. For project managers and owners, accuracy in this process protects budgets and relationships. For contractors, it secures steady cash flow and credibility. The best teams treat every application as proof that the project is moving forward with clarity and control.

.avif)

.avif)