Commercial real estate project management helps ensure investments stay on track by coordinating designers, contractors, and lenders while protecting financial goals. In this guide, you will learn how the management process works, who is involved, and the best practices for keeping capital safe.

What is Commercial Real Estate Project Management?

Commercial real estate project management is the oversight of property development from initial feasibility to final delivery. It ensures a project meets financial goals and market requirements. This process coordinates the professionals needed to transform an investment vision into a physical asset.

In commercial real estate development, the project manager's scope covers office towers, retail centers, industrial parks, and mixed-use developments. The role of the PM includes responsibilities such as site selection, land-use rights, and tenant coordination. Strategic coordination links high-level investment strategy with on-site execution.

Effective management of CRE projects protects profitability by mitigating risks before they impact the project budget. Strategic oversight aligns the interests of investors, lenders, and municipal authorities. The priority is maintaining project solvency while meeting strict delivery deadlines.

Commercial vs. Residential Real Estate Project Management: Key Differences

Commercial and residential real estate project management uses the same fundamentals, but commercial work usually involves more stakeholders, more coordination across contracts and funding, and tighter documentation. The biggest difference is complexity, which raises cost and schedule risk.

Commercial projects demand tighter decision-making and documentation because more parties depend on the same information. A common pressure point is timing. Funding or approval gates can slow progress if reporting and sign-offs are not ready, while procurement still needs decisions to avoid schedule slips.

Who’s Involved in CRE Project Management?

The project manager acts as the central authority orchestrating every phase of the project life cycle. This leader collaborates with a network of financial, technical, and legal professionals to ensure the asset meets its performance targets.

Effective delivery requires constant coordination between the following roles:

- Project Owner or Developer: The primary entity holding financial risk and establishing the project's core vision.

- Project Manager or Owner's Rep: The strategic leader acting on the owner's behalf to oversee execution.

- Equity Partners: Private or institutional investors providing the cash required to fund the development in exchange for ownership.

- Lenders: Financial institutions providing debt that must be managed according to strict loan covenants and drawdown schedules.

- Architects and Engineers: Lead designers and technical consultants responsible for creating code-compliant blueprints and systems.

- General Contractor: The construction firm managing on-site labor, materials, and specialized subcontractors.

- Tenant Representatives: Agents ensuring the building's final layout and infrastructure meet the operational needs of future occupants.

- Property Manager: The operational team that manages the building's daily maintenance and tenant relations once construction is complete.

- Municipal Authorities: City planners and inspectors who grant the permits and approvals necessary for legal operation.

Each participant brings conflicting priorities that can stall progress. For example, a lender might demand cost cuts while a tenant requires expensive infrastructure upgrades. The project manager navigates these tensions to ensure one party's request does not violate another's legal or financial requirements.

How Does the Commercial Real Estate Project Management Process Work?

The commercial real estate project management process is a phased framework that moves an asset from an investment concept to a functional building. It organizes complex activities into distinct stages to manage financial risks and verify regulatory compliance. This structure ensures every milestone aligns with the intended return on investment.

1. Initiation and pre-development

In commercial real estate development, everything starts with feasibility. This phase involves site selection, market analysis, and preliminary budgeting to confirm that the project can generate profit. The project manager oversees due diligence by checking for environmental issues, zoning restrictions, and utility capacity.

Once the numbers work, the owner secures seed capital to move into design. Expert management at this stage validates the pro forma to ensure the projected yield meets the owner’s investment criteria. This foundation prevents the project from advancing on flawed financial assumptions.

2. Design and development approvals

Architects and engineers translate the business vision into construction drawings. The project manager leads the team through the approval process to secure formal permits from city councils and planning boards. This phase often involves balancing the owner's needs with city zoning requirements.

Success requires finalizing a design that maximizes usable square footage within legal limits. This volatile stage frequently involves community pushback or regulatory hurdles that can force major design changes. Managing these risks early protects the budget from expensive revisions later in the development cycle.

3. Procurement and pre-construction

The focus shifts to hiring the build team once approvals are secured. The project manager issues bid packages and negotiates contracts with the general contractor or construction manager. They also finalize the master schedule and establish cost control systems.

Project managers use bid leveling to compare contractor prices and ensure no hidden costs exist in proposals. This stage establishes the guaranteed maximum price contract to protect the owner from price hikes. Locking in materials and labor early provides the price certainty needed before construction begins.

4. Construction execution

Physical work begins on-site while the project manager handles the administrative side of the build. They process payment applications, manage change orders, and track progress against the project schedule. The priority is managing the paper trail that controls the project's cash flow.

The project manager verifies that each payment request aligns with the work completed on-site. This oversight prevents front-loading, where a contractor requests more money than the progress they have made. Constant communication between the field and the office resolves technical conflicts as they arise.

5. Closeout and commissioning

The final phase involves testing all building systems, like HVAC and life safety, to ensure they meet design standards. The project manager compiles as-built drawings, operation manuals, and warranties for the owner. This ensures the property management team has everything needed for daily operations.

The project ends when the building receives a Certificate of Occupancy and final retention payments are released. Successfully navigating this transition protects the owner from unnecessary interest expenses. The process concludes when the project shifts from construction to revenue-generating operations.

💡 Pro Tip: Start a digital folder for warranties, lien waivers, and testing reports the moment construction begins. When you provide an audit-ready package immediately after completion, you accelerate the transition from high-interest construction debt to a stable permanent mortgage.

How to Manage the Financial Lifecycle of Commercial Property Development

Managing the financial lifecycle requires aligning construction spending with the project’s capital stack and lender release schedules. This oversight ensures the project stays solvent and complies with all bank covenants as described in the following phases:

Effective management centers on the FTC to ensure the project remains bankable until the occupancy permit is issued. This strict oversight protects the owner's cash reserves by ensuring the building's income potential always satisfies the lender's mortgage coverage requirements.

Common Challenges and Solutions in Managing Commercial Property Projects

Managing commercial projects requires overcoming systemic hurdles that threaten both the physical build and the financial stack. Success depends on effective risk management and the application of expert strategies to keep the asset viable.

💡 Pro Tip: Maintain an Issue Log that tracks the financial impact of every delay, allowing the team to make data-driven decisions about when to spend more on speed versus accepting a delay.

Best Practices for Commercial Real Estate Project Management

Maximizing an asset's value requires locking in costs early and maintaining an airtight audit trail for every dollar spent. Integrating design and construction teams during pre-construction resolves technical conflicts before they become expensive field errors.

☑️ Lock in Early Procurement: Purchase long-lead items like electrical switchgear or HVAC units immediately after design approval to avoid global supply chain delays.

☑️ Enforce Strict Change Management: Require every budget adjustment to have a written justification and formal sign-off to prevent unauthorized spending from draining the contingency.

☑️ Level Every Bid: Compare contractor proposals line-by-line to ensure they include identical scopes of work and exclude hidden fees or assumptions.

☑️ Conduct Regular Site Audits: Verify that physical progress on the ground matches the percentage of completion claimed in the monthly pay applications.

☑️ Maintain a Centralized Document Hub: Store all permits, warranties, and lien waivers in a single digital location that is accessible to the owner and the lender.

☑️ Standardize Reporting Intervals: Distribute weekly progress updates that focus on the Forecast to Complete to give stakeholders early warning of potential budget issues.

💡 Pro Tip: Standardize a retainage release roadmap during contract awards. Define the exact paperwork required for the final payment before signing any contracts. This forces subcontractors to organize documents throughout the build to avoid closeout delays.

Project Management Tools for Commercial Property Project

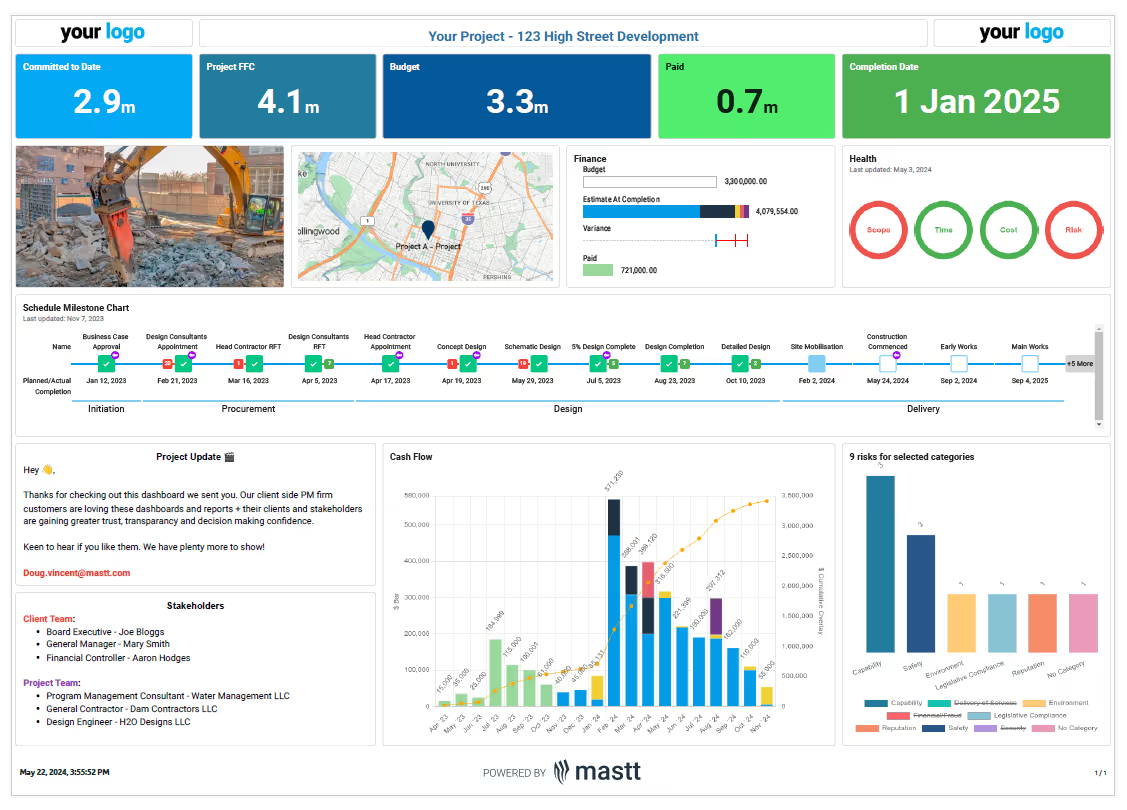

Data-driven project management requires a suite of tools that bridge the gap between field activity and financial oversight. You must use platforms that centralize document control, budget tracking, and project scheduling to ensure every stakeholder sees the same real-time data.

Construction project management software like Mastt creates a single source of truth by integrating these functions. This automation is vital for maintaining transparency with institutional investors who require detailed spending breakdowns.

Take Control of Your Commercial Real Estate Projects

You take control of commercial real estate project management by using real-time data to catch budget risks early. Centralizing your field and financial updates prevents the communication gaps that trigger expensive project delays. Review your reporting workflow today to see how a platform like Mastt can sharpen your financial oversight.